1271 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter applies or tax for any previous year of assessment remaining unpaid and those regulations may in particular and without prejudice to the generality of the foregoing include. Power to transfer cases 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording.

Clubbing Of Income Under Income Tax Act 1961 With Faqs

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of.

. Section 127 Income-tax Act 1961. Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for. Non-chargeability to tax in respect of offshore business activity 3 C.

Section 127 of the Income Tax Act. Procurement of raw materials components and finished products. Short title and commencement 2.

Version of section 1273 from 2004-08-31 to 2013-06-25. Version of section 1273 from 2004-08-31 to 2013-06-25. Business planing and co-ordination.

Originally the CARES Act was a temporary measure allowing tax-free principal or interest payments made between. Show posts by this member only Post 1. Of this section is exempt from income tax under subsec.

Gross income of an employee does not include amounts paid or expenses incurred by the employer for educational assistance to the employee if the assistance is furnished pursuant to a program which is described in subsection b. Claim incentive under section 127. In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976.

104127 title VII 780 Apr. Internal Revenue Code Section 127b3 Educational assistance programs a Exclusion from gross income. Paragraph 1273b or subsection 1273A of ITA 1967 entitled to be claimed as per the Government gazette or Ministers approval letter.

Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal. Scientific research and experimental development tax credit for the year and b unused scientific research and experimental development tax credit for. Charge of income tax 3 A.

1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after. 1 Paragraph 1273b of ITA 1967 Exemption given by the Minister of Finance to any class of persons from complying with any provision of the Income Tax Act 1967 either generally or in respect of any income. Service of notice summons requisition order and other communication.

The expansion of Section 127 allows employers to make payments for student loans without the employee incurring taxable income and the payment is a deductible expense for the employer resulting in tax advantages to both parties. Income Tax Act. Advantage Strategic Consulting Private Limited Vs PCIT Madras High Court Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot have any right to choose his Assessing Authority as no prejudice can be said to have been caused to the.

This is incentives such as exemptions under the provision of paragraph 1273b or subsection 127 3A of ITA 1976 which is claimable as per government gazette. This Act may be called The Income-tax Act 1961. General management and administration.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Section 1273b exemptions made under gazette orders Section 1273A exemptions given directly by the Minister of Finance. 3 LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Apr 4 2018 0140 PM updated 5y ago. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount. 2 - DIVISION A - Liability for Tax.

Power to transfer cases. Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for.

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

Private Company Employee Income Tax Calculation 2022 Reimbursement Pf Gratuity Hra Lta The Financial Express

Penalties Under Income Tax Act 1961

What Are The Benefits Available For Start Ups Under The Income Tax Act Taxmann Blog

Income Tax Act 1961 Objectives Laws Sections

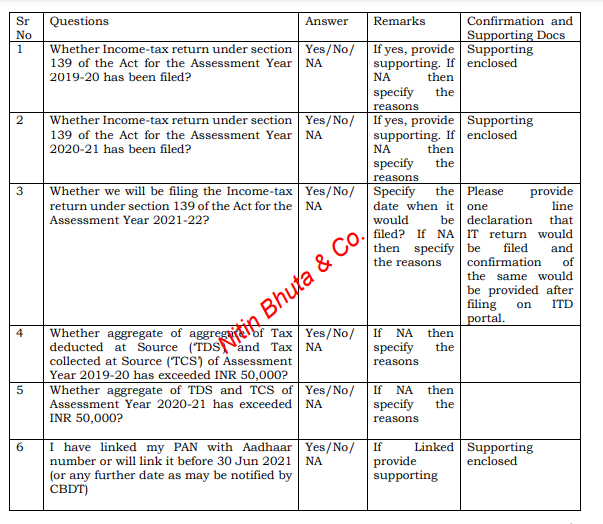

Section 206ab Changes As Applicable From July 1 2021 Declaration On The Filing Of The Tax

Section 10 Of Income Tax Act Exempted Income Under Section 10

Change Of Assessing Officer And Jurisdiction For Income Tax Sid Associates

Section 282a Of Income Tax Issue Of Income Tax Notice Indiafilings

Income Tax Case Laws Set Off Carry Forward Of Losses Section 70 To 80 Income Tax Act

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Pdf Income Tax Sections List Pdf Download Instapdf

Faqs On Tds On Contracts Section 194c